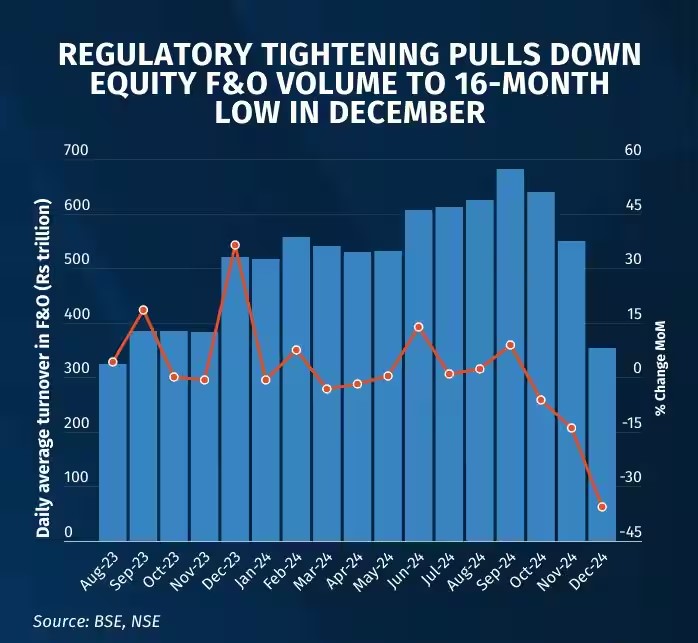

The Securities and Exchange Board of India’s (SEBI) tightening measures have led to a significant decline in equity Futures & Options (F&O) trading volumes, which hit a 16-month low in December.

The combined Average Daily Trading Volume (ADTV) for the Futures & Options (F&O) segment on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) saw a sharp decline in December, dropping to ₹280 trillion, the lowest level since June 2023. This represents a significant 36.56% decrease from ₹442 trillion recorded in November.

Contrary to the decline in derivatives, the cash market turnover, which had been declining for five consecutive months, witnessed a 4.4% month-on-month increase in December.

According to Shrey Jain, Founder & CEO of SAS Online, recent measures by the Securities and Exchange Board of India (SEBI) have prompted traders to exercise greater caution when initiating new positions. This has led to a noticeable decline in turnover within the derivatives segment in recent months. Furthermore, Jain anticipates that the introduction of larger contract sizes for weekly derivatives, set to take effect from January 1, could result in a further reduction in trading volumes.

.png)

update

ReplyDelete