Based on supplier returns submitted till November 30th, 2022, the GSTN has updated its computation of ITC.

GSTN has updated the below instructions on GST Portal:

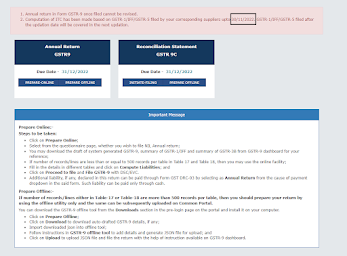

- Annual return in Form GSTR-9 once filed cannot be revised.

- Computation of ITC has been made based on GSTR-1/IFF/GSTR-5 filed by your corresponding suppliers upto November 30, 2022. GSTR-1/IFF/GSTR-5 filed after the updation date will be covered in the next updation.

.png)

Right

ReplyDelete